Sterling Update

Firstly, please be reassured that our ‘remote working’ systems and controls have operated well during this period of uncertainty. We are keeping the office manned to maintain critical systems and to open the mail, but most staff are now working from home. Everyone is available by phone or email.

We will be writing a short update weekly to keep our clients informed of our thoughts, but we are here to help if you have any individual queries or concerns.

This week we want to focus on the reasons why it is important to remain invested through both good times and bad. Nevertheless, before we move forward, please be mindful that we will never encourage you to maintain a portfolio if it causes an unhealthy level of worry. If you have any concerns or wish to discuss your level of risk, please get in touch.

You should also bear in mind that the data we have used in this update specifically relates to the equities (shares) held within a portfolio. Our clients all benefit from mixed strategies, which include bonds, property and hedge strategies, along with shares. Mixed portfolios are less volatile because of the diversification, but they tend to produce lower returns during prolonged periods of stock market gains.

Why stay invested?

Investors understand that stock markets falls are inevitable, but over the longer term, the good years outweigh the bad ones. In the midst of a crisis however, investors can become irrational, which often leads to poor decision making. We do not know whether the markets will fall further, or if they will rebound quickly – nobody does. Though we can take great confidence from the many downturns that have preceded this one: longer term investors are rewarded well for their patience.

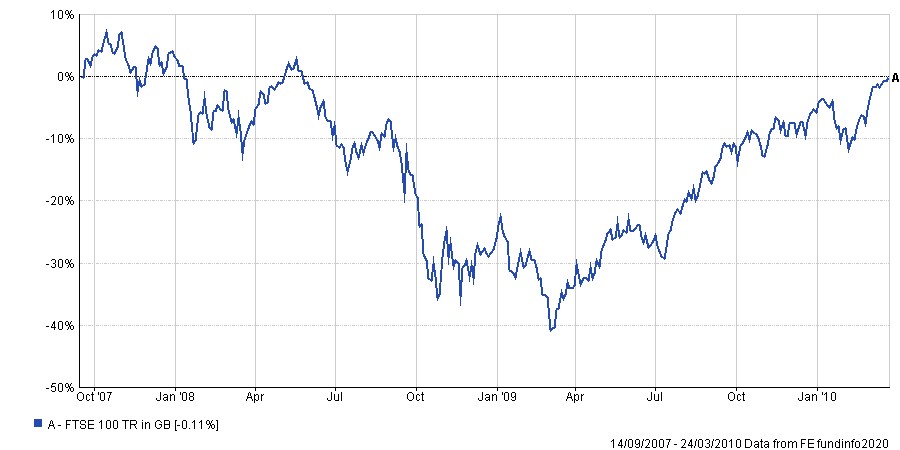

The chart below tracks the performance of the FTSE 100 from when the queues first appeared outside Northern Rock (September 2007) until its full recovery, two and half years later (March 2010).

In the five years that followed (24th March 2010 to the 23rd March 2015) the market, including reinvested dividends, increased by almost 48%.

Allowing for charges, even if you chose the worst possible time to invest in a generation, after 7 ½ years your average compound annual return would have been 4.60%. Over the same period, interest rates fell sharply.

In hindsight it is very easy to review the chart and question why investors, guided by professionals, did not simply draw their money out at the top of the market, then reinvest in March 2009 when the market started to recover. The simple answer is no one knows when the market will fall or rise, but every professional investor does know that missing just a few of the good days can make an enormous difference to the long-term success of a portfolio. Nothing demonstrates this better than Tuesday and Wednesday of this week – the FTSE 100 rose by just under 14%.

To put this in context, you would need to leave your money in the Nationwide Building Society (at current rates) for 25 years to match what the FTSE 100 delivered in just 2 days.

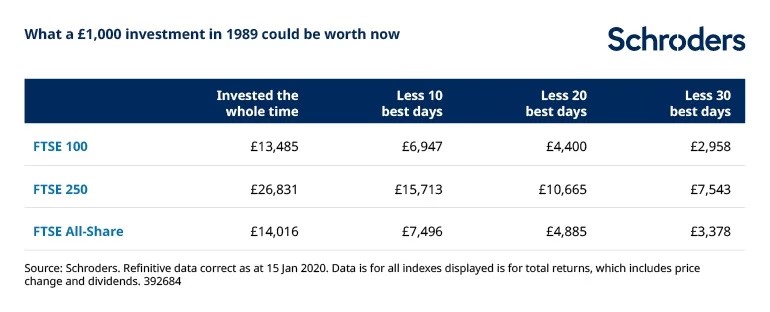

Our colleagues from Schroders Unit Trusts Limited have provided this infographic, highlighting the importance of holding your nerve. The table compares the difference in the long-term return when the best 10, 20 and 30 days are missed against just leaving your money invested throughout.

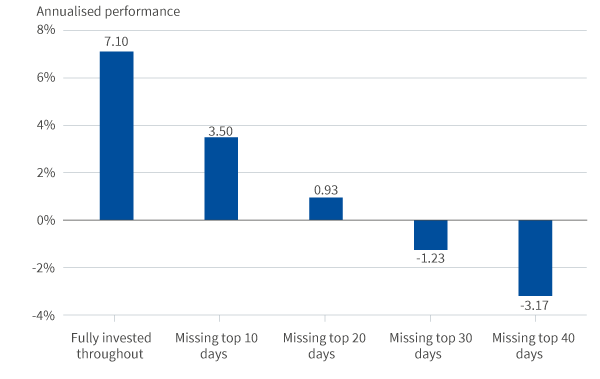

Importantly, this is not just a UK phenomenon, the same applies across international markets. The chart below is courtesy of Lipper, a Thomson Reuters company, reviewing data from the US market (the S&P500) from the 31 December 1999 to the 31 December 2019.

The evidence to support maintaining the equity component of your portfolio through both good times and bad is clear. Trying to time the market involves second guessing central banks, politicians and the behaviour of millions of investors globally. It is simply guesswork, which sometimes will work in your favour, but will mostly result in longer term damage to your investment return.

That said, those making regular withdrawals will need to consider some changes in the weeks to come. As you know, our recommended portfolios consist of several funds. When making withdrawals, it is best to avoid drawing money from the investment funds that have been significantly impacted by the recent outbreak and instead, increase the withdrawal from the funds that have been largely unaffected. We will be in touch with those concerned over the next few weeks.

Finally, we fully appreciate that some investors struggle to comprehend their investment horizon, especially in retirement. You must simply ask yourself how your life would be affected if your investment or pension valuation was less next year. If you feel your life would be impacted by a fall in the value of your investments over a short period, then we need to make some adjustments. Otherwise holding station is the best course of action.

As always, please get in touch if you have any queries or concerns.

Disclaimer

Issued by Sterling Financial Services Ltd, which is regulated and authorised by the Financial Conduct Authority. The contents of this update do not constitute advice and should not be taken as a recommendation to purchase or invest in any of the products mentioned. Before taking decisions, we suggest you seek advice from one of our qualified and authorised financial advisers. All figures and the information provided are correct at the time of writing. Past performance is not necessarily a guide to future returns, and the value of investments can fall as well as rise. You may get back less than you have invested. If you have any comments or suggestions on how to improve the monthly update or would like to be removed from our current email list, then please send an email to info@sterlingfs.co.uk or use the unsubscribe link below.